You’re an Amazon seller overwhelmed by your tax obligations, accounting and bookkeeping duties?

Time to hire an expert!

We’ll show you how to find the best Amazon seller accounting and bookkeeping services.

- What Is an Amazon Seller Accounting Service?

- What Can an Amazon Accountant Do for You?

- Why Should You Work with an Amazon Accountant?

- What Makes a Good Amazon Seller Accounting Service?

- How Much Does an Amazon Accountant Cost?

- Where Can You Find Qualified Amazon Bookkeeping & Accounting Services?

- What Does Working with an Amazon Accountant Look Like?

- Checklist: How to Find the Best Amazon Seller Accounting Service

What Is an Amazon Seller Accounting Service?

Accountant, bookkeeper, CPA, tax consultant, financial advisor – there are so many job titles in the universe of business finance that it is easy to lose track of who is who and who does what.

So before we can explain what exactly an Amazon accountant can do for you, we first need to define what an accountant actually is.

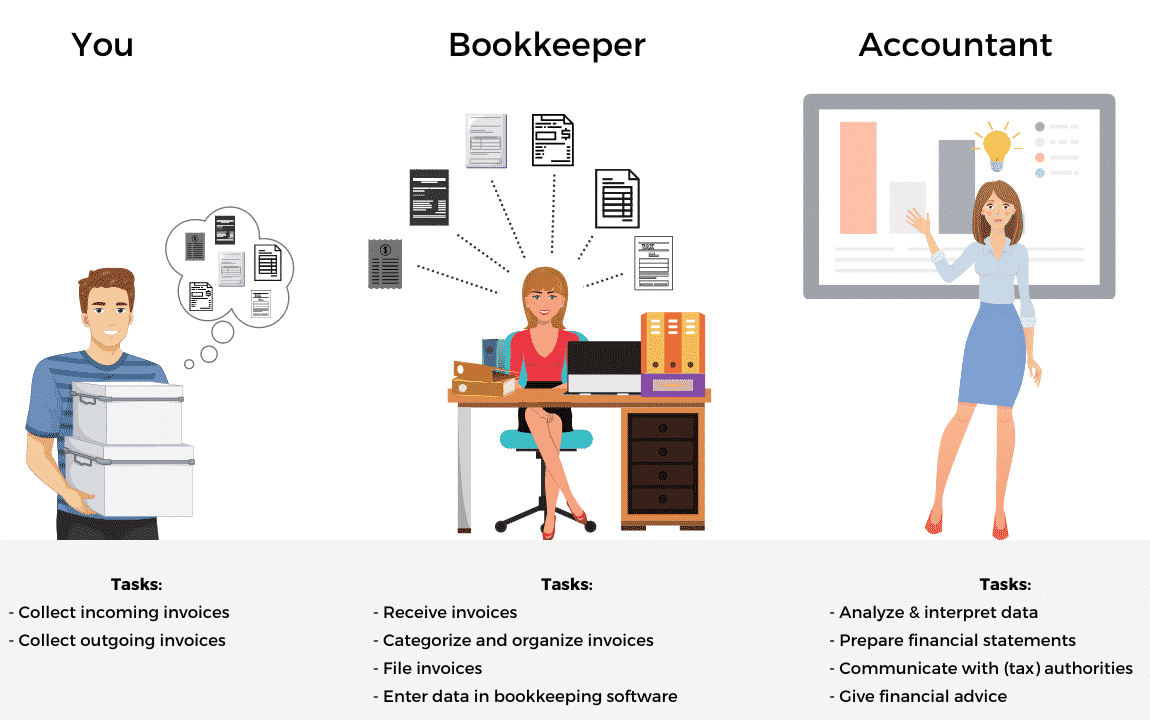

The most common terms that are used interchangeably are accounting and bookkeeping.

Many people think that these two things describe exactly the same activity, but that is not quite the case.

What is the difference between an Amazon accountant and an Amazon bookkeeper?

Many accountants, if not most, offer bookkeeping services alongside their accounting services.

Bookkeepers, on the other hand, usually offer their bookkeeping services only.

Thus, one could say that bookkeeping can be a part of accounting, but not the other way around.

Let us take a closer look at both services.

Amazon Bookkeeping

In general, bookkeeping is mainly concerned with identifying, categorizing, and recording transactions within your company.

In simple terms, both incoming and outgoing invoices are gathered, sorted, and filed in an orderly manner.

The goal is to document all financial transactions in a neat, well-structured way so that both internal and external parties (such as the tax authorities) can easily find their way around to quickly understand when, why and by whom payments were made or received.

Simple bookkeeping does not involve making calculations, preparing financial statements, or interpreting the numbers in any way.

It is essentially the mere compilation of financial data.

Accordingly, unlike an accountant, an Amazon bookkeeper does not need any extraordinary math or analysis skills.

It is sufficient for the bookkeeper to have a flair for orderliness and accuracy so that no mistakes occur in the documentation of transactions.

Amazon Accounting

The tasks that an Amazon accountant takes on and the skills he must have exceed those of a simple bookkeeper considerably.

Simply put, an accountant is a financial expert who is there to monitor, document (if they also offer bookkeeping), and interpret your cash flows.

He is also able to make reliable statements about your overall financial performance.

Basically, their job is to monitor the health of your business by strictly controlling profits and losses.

An accountant can, therefore, analyze and interpret the books kept by you, your bookkeeper or your internal bookkeeping department.

They also keep an eye on your tax obligations and prepare financial statements for you.

In a nutshell: An Amazon accountant helps you with all complicated and time-consuming financial issues you have.

So in a nutshell, it’s your job to collect invoices and pass them on to your bookkeeper.

The bookkeeper collects and organizes all documents and prepares them for the accountant.

Once the accountant has received the documents, they will start to analyze them and then make statements about the financial situation of your business, give recommendations for action, determine your tax obligations and communicate with the tax authorities.

What Can an Amazon Accountant Do for You?

In this article, we are assuming that an accountant will also do the bookkeeping for his clients and add this to his range of services.

Let’s take a closer look at these and see what you can expect from an Amazon seller accounting service:

Collect Your Invoices

Just kidding, unfortunately, there’s no one from outside your business who can do that for you.

So keep all the invoices you receive and the ones that you send to your customers.

If you have employees, make it clear to them that they should keep all tax-deductible invoices (such as travel expenses or invoices from lunches with business partners) and give them to your bookkeeping department or directly to the accountant.

It is best to keep all invoices in one place.

PRO TIPOrganization Is Key

Organize your invoices right away and put them in chronological order. That makes the accountant’s work a lot easier.

In the end, this saves you and your account an enormous amount of time when it comes to putting the numbers in your books.

In addition, you usually have to pay your accountant less if you provide them with pre-sorted documents, as he will have less work to do.

Keep in mind that your accountant will not chase after you or your employees and beg them to submit their invoices.

But if you’re working with an accountant, collecting, storing (and not losing) your documents is literally all you have to do.

Bookkeeping

As mentioned before, usually an Amazon accountant or accountant firm also provides Amazon bookkeeping services.

That means you can hand them over a big pile of unorganized documents and they will bring everything in order and put the numbers in the bookkeeping system for you.

Yay!

Handling Payroll

If you employ staff, you have to manage their payroll.

Or, you can let your accountant do it.

He keeps track of the hours that have been worked, calculates the payroll, and puts the accurate amounts of payroll taxes and other fiscal payments that need to be made directly aside.

Tax & Entity Formation Consulting

Taxes are complicated.

Some people spend years studying the tax system and still can’t get it right.

Especially when you start a new business or expand to another country, it can be difficult to understand the (new) tax environment.

An Amazon experienced accounting service can advise you on what type of business is right for you, how to save taxes, what you can deduct, and so on.

Tax Registration

Besides providing tax advice, most accounting firms will also take care of the tax registration for you.

For example, if you are expanding from the USA to Europe, your Amazon accountant will take care of the VAT registration in each country.

Vice versa, if you expand to the US market, your accountant will help you with sales tax registration in the states where the tax burdens are lowest.

Preparation of the Profit and Loss Account & Tax Declaration

One of the most important responsibilities of your accountant is to determine the profits and losses that your business makes and has made in the past.

Therefore, one of their core skills involves the preparation of profit and loss accounts.

These are not only important for monitoring the financial health of your business, but also for determining your tax burden.

Speaking of your tax burden, we have some good news for you: your accountant will also do your tax declaration for you.

Since now a professional is taking care of it, you no longer have to be afraid of high additional payments or fines for having mistakes in your tax declaration.

Keep you Updated

Laws and regulations are constantly changing.

Your accountant will always keep you up to date and thus ensure that you remain compliant.

This is important because non-compliance can lead to high penalty payments.

In addition, when new laws are introduced, your accountant will find new ways to save on taxes as much as possible.

Give You Business Advice

You should always make financial decisions with caution.

An accountant can give you sound business advice because he is familiar with all your cash flows, earnings, and expenses.

They can also apply the knowledge they have acquired from their other clients to your business.

For example, they can advise you on how to use your budget most efficiently and where you can cut costs.

Communicate with Auditors and Authorities

Another reason to work with a professional Amazon seller accounting service is that your accountant can handle the communication with public offices and tax authorities.

This is a major advantage since public authorities often speak their own language.

And if you can’t speak or interpret this – sometimes confusing – language, you may make serious mistakes when filling out official forms, applications, or other paperwork, which can cost you a lot of money.

Why Should You Work with an Amazon Accountant?

Now that we have seen what tedious tasks an accountant can relieve you of, we will now talk about the advantages that come with it.

Gain Time & Focus

One point that is quite obvious is that you will save yourself a lot of time if you outsource your Amazon seller accounting duties to a professional.

Instead of spending days going through your books, hours of googling accounting tips, and watching “taxes for dummies” videos on YouTube, you can just spend some money on an accountant and get rid of these tasks.

Accordingly, this time saving allows you to focus on other things in your business that you are probably better at.

Developing new products, optimizing your listings, planning marketing campaigns – now you have the time, energy, and focus to do all this as you don’t have to worry so much about your finances anymore.

Trust in Accuracy

Many entrepreneurs who fail do not fail because they are not ambitious enough or because their product is poor, but because they are not in control of their finances.

A solid financial structure, a constant overview of all cash flows, and the financial health of the company constitute the foundation for every business.

Your homemade Excel spreadsheet and $5-per-month accounting software may be enough to get you started in your entrepreneurial career, but once your monthly transactions exceed a certain amount, it’s time to start looking for a professional solution.

Let’s say you get to a point where you sell 60-70 products a day.

If you need to transfer all these numbers into your accounting system yourself, you will firstly, as mentioned above, not have any time for your actual business anymore and secondly, your error rate will most likely be much higher than the one of a professional Amazon accountant.

Do you really have the time and patience to make sure that every Sunday, over 450 transaction details are recorded correctly in your books?

I didn’t think so either.

Stay Tax Compliant

Non-accurate books can also have serious consequences for you and your business.

Whether it’s the German Finanzamt, the Spanish Agencia Tributaria, or the American IRS: tax authorities take their citizens’ tax obligations very (!) seriously.

If you submit an incorrect tax declaration or miss any deadlines, you could face high back payments and penalties.

You can minimize this risk by entrusting an accountant with handling your tax obligations.

Save Money

Sounds weird, but spending money on an accountant can actually save you money.

Firstly, as just mentioned, you can be almost 100% sure that your accountant will not miss any official deadline and therefore protect you from facing any submission delay fines.

Secondly, they will prepare and submit accurate financial statements to the tax authorities.

This will save you potential penalty costs too.

In addition, the sentence “time is money” applies here as well, even if it sounds trite.

Say you work 50 hours a week, so 200 hours a month.

And let’s say you make $6,000 in profits every month.

This means that your hourly net wage is equivalent to 30 dollars (6000 divided by 200).

If you now spend twenty hours a month doing accounting, you are investing $600 a month in bookkeeping and accounting.

That is 7200 dollars a year.

Let me tell you, hiring an accountant is a lot cheaper.

Gain Knowledge & Learn Valuable Tips

Another thing you can benefit from when you hire an Amazon accountant is their wealth of knowledge.

Your accountant can explain things you do not understand and give you valuable tips on how to handle your finances.

For example, while you would have to spend hours learning which tools are suitable for your requirements, how to use them, and which things you need to be aware of, an accountant can tell you exactly which one you should use and how to use it.

Of course, he also knows the tax system inside and out, so they can give you the best advice on how to save on taxes.

Expand the Right Way

Another thing that an account can (or even must) help you with is when you expand to another country or countries.

If you think the tax laws in your home country are difficult to understand, think about how it is in countries where another language is spoken and you know absolutely nothing about the laws and taxes there.

Sometimes not even the style of taxes is the same.

In Europe, there is the VAT (value added tax) system and in the USA the sales tax system.

So before you make costly mistakes, get advice from a local accountant on which company structure is best for you and how you can best save taxes in the respective tax system.

PRO TIPGet an Accountant Right from the Start

Hire an accountant right at the beginning of your entrepreneurial journey. If you keep your finances neat and orderly right from the start, you will save yourself a lot of headaches.

What Makes a Good Amazon Seller Accounting Service?

Now that you know about the advantages of hiring an accountant and what they can do for you, we will focus on the qualities of a good accountant:

Accuracy & Attention to Detail

Since your accountant has to deal with many, many transactions, the most important thing is that he has an eye for detail and works very accurately.

No payment should slip through or be forgotten.

Organizational Skills & Time Management

If you hire an external Amazon accountant, you will probably not be their only client.

This means that they have to remember not only the deadlines concerning your business but also those of their other clients.

Obviously, this requires them to have excellent time management and organizational skills.

Knowledge & Experience

Another important aspect is the experience and expertise of the Amazon Accountant.

Experience does not only include the experience with your branch or industry, but it is also important that the accountant has extensive experience in working with Amazon sellers and knows how the Amazon marketplace business works by heart.

Compared to brick and mortar customers or conventional eCommerce sellers with their own online shop, there are some peculiarities when it comes to selling on Amazon.

Therefore, the accountant should understand the nature of the Amazon ecosystem as well as you do, know the unique characteristics and what to pay close attention to.

Creativity

Most people start to yawn when they hear the terms bookkeeping or accounting because this profession is associated with boring processes, rigid guidelines, and monotonous workflows.

But one of the most important qualities of an accountant is actually creativity.

Although the laws and regulations are set by governments and have to be followed, creativity is still required.

Within the legal framework, your accountant must be able to find creative solutions for saving taxes and avoiding unnecessary fees.

They must be able to steer your business through a sea of regulations and know what business decisions are best for you, such as where to locate your headquarters, what type of business is ideal, and where to pay taxes.

Up-To-Dateness

Laws and regulations are constantly changing, especially when it comes to taxes and corporate payment obligations.

Therefore it is of great importance that your accountant is always up to date.

Firstly, this ensures that you stay compliant, and secondly, any new loopholes in the law and tax reliefs can be implemented quickly.

Software Affinity

Speaking of being up to date: A good accountant and/or bookkeeper should know what (Amazon) bookkeeping and accounting software is out there and how to use it.

Since all business areas are increasingly being handled digitally, your accountant should also be equipped and be prepared to work with appropriate software.

Communication & Reachability

Lastly, it is important to mention that good communication is the key to a professional and good business relationship.

Your Amazon accountant should be well reachable and respond quickly, especially during the “tax season”, i. e. when the tax declaration has to be prepared and submitted.

How Much Does an Amazon Accountant Cost?

Unfortunately, there is no universal answer to the question of how much an Amazon accountant costs.

First of all, there are many different billing methods.

Some accountants charge a rate per hour, per month or per year, a fixed price per tax declaration, and so on.

In addition, the scope of the services also differs from one service provider to another.

Is bookkeeping included or not?

Do you want regular consulting sessions?

Should the accountant prepare monthly reports?

All these factors influence the costs of an accountant.

In addition, the rates also vary from country to country, according to the accountant’s company size, your company size, and according to their professional experience.

If you want to pay your accountant by the hour, rates range from $30/hour if you’re a small business up to $500/hour or more if you’re a large corporation.

Subscription-based models range – again, depending on your needs and company size – from $75/month up to $1.000/month or more.

If possible, it is advisable to agree a service contract with fixed fees.

This will allow you to better plan your budget since you know the exact amount you will have to pay eventually.

To conclude this part, please do not be deterred by these prices but rather consider paying for an accountant as an investment rather than a financial burden.

Remember: if you don’t hire an accountant, you will have to take care of all the work yourself and the risk of making mistakes, which will eventually cost you a lot of money, will increase.

Where Can You Find Qualified Amazon Seller Accounting Firms?

Hopefully, you are convinced by now how important it is to have a professional Amazon accountant for your business.

Now, let’s focus on the question of where you can find a good accountant.

First of all, it is important to mention that it makes sense to hire an international accounting firm if you are selling or plan to sell in multiple countries.

This way you get all your bookkeeping and accounting needs from one single source, which makes communication a lot easier.

Imagine having 6 different accountants for the 6 different Amazon Marketplaces in Europe – the risk of miscommunication is much higher than if you have only one accounting company for all 6 countries.

If you sell in one country only, you should definitely work with a local accountant, because they know the local laws and the related tips and tricks on how to save taxes and other fees best.

For example, if you live in Argentina but want to sell on Amazon.com, hire a local Amazon accountant in the USA.

But before you rush to Google and search for “Amazon Accountant USA” or “Amazon Accountant Europe”, you might want to check out our alternative.

The problem with simply googling accountants (or service providers in general) is that you won’t necessarily see the best Amazon seller accounting and bookkeeping companies on the first page, but simply the ones that have invested the most in SEO.

Their ranking says nothing about their experience and competence.

This means that you patiently have to click your way through dozens of (sometimes very confusing) websites of Amazon bookkeeping and accounting companies.

And in the end, you probably still won’t have found the perfect fit for your company.

As you can see, finding a good account for your Amazon business can be hard and exhausting.

But it doesn’t have to be.

On Sermondo, you can easily find various excellent Amazon seller accounting services.

Let’s dive into a few of the advantages that using Sermondo to find an accountant has:

Specialization in Amazon Sellers

On Sermondo you will not find ordinary accountants.

Every accountant listed on Sermondo is specialized in working with Amazon sellers.

This means that each and every one of them knows 100% how your business works and what they have to pay special attention to.

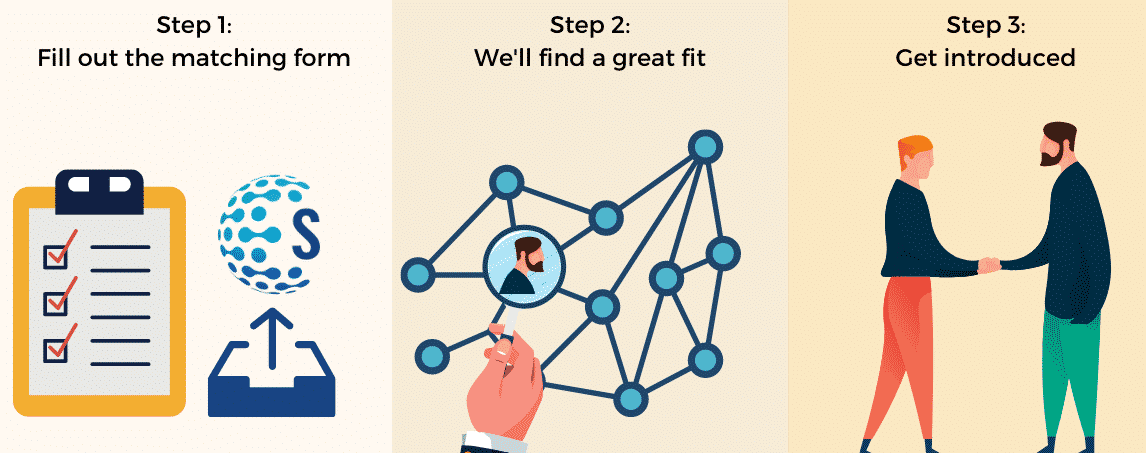

Personalized Manual Matching Service

Besides the possibility of exploring and comparing listings by yourself, we offer our users an additional free matching service.

How that works?

In less than two minutes, you simply fill out the matching form that tells us exactly what you need.

We receive your inquiry and will immediately start looking for a suitable Amazon accountant for you – no matter in which country or countries you sell.

Concise Overview

Although our matching service is very convenient, you don’t have to use it.

You can also browse and compare the accountants yourself if you want to.

The one-page listings on Sermondo have the enormous advantage that, compared to a conventional website, they show the most important information about the service provider at a glance.

No more tedious, endless hours of navigating through all the “gibberish” that many companies have on their site.

On our site, you will find all the information you are interested in one single place.

Nicely structured, clearly arranged, and without unnecessary fuss.

Transparency & Reliability

Another advantage that Sermondo offers is the high level of transparency.

Sellers can leave reviews for the service providers they have worked with.

The sellers evaluate overall satisfaction, service quality, pricing, and communication.

Thus, you can fully rely on the experience of former clients when making your hiring decision.

ALL SERMONDO REVIEWS ARE REALWe verify every single review on our platform

All reviews on our site are real. No service provider can evaluate themselves or fake their reviews. Every review that we receive is checked and verified. For example, the person that leaves a review needs to provide proof that collaboration actually took place.

Global Services

Sermondo is an international intermediary platform for Amazon services.

That means that we list accountants from all over the world.

So no matter where you are selling – you will find the right service on Sermondo through our global network.

If we should not yet have a provider in the country of your preference, you can write to our support team and we will directly vet and onboard a suitable provider.

What Does Working with an Amazon Account Look Like?

Be Clear About Your Requirements

When you work with an accountant, you should be open about your expectations regarding the collaboration from the very beginning.

Clarify right from the start what you see as your accountant’s responsibilities and what falls under your area of responsibility.

This is all part of “managing expectations”: if both parties know in advance what the other expects and what is required of them, nothing stands in the way of a good business partnership.

Don’t Be Afraid to Ask Questions

Another important point when working together is that you always ask questions when you don’t understand something.

An accountant’s terminology can be very confusing.

Therefore, do not hesitate to ask questions if you feel that you have no idea what is going on.

After all, it is also your accountant’s job to educate you and to convey his knowledge in a comprehensible way.

Trust their Expertise

Thirdly, if you hire an Amazon seller accounting service, you should trust their expertise.

If you micromanage your accountant, you basically pay double: the cost of the accountant and the time you invest in constantly monitoring him and his work.

Don’t get us wrong, we’re not saying that you shouldn’t monitor your accountant’s work at all – but you should do so at a reasonable level.

To really benefit fully from his work and expertise, you need to learn to let go a little.

Communicate Frequently

Another important thing is that you stay in the loop.

You should know what’s going on right now and what’s next.

Because even if you have an accountant, in the eyes of the law you are still the main person responsible for your business, and in the end, you have to take the consequences for mistakes and delays.

So even though you should trust the accountant and not be constantly breathing down their neck, you should still communicate regularly to know what’s going on.

Provide necessary information on time

An accountant is a true blessing.

So much of the work that used to be done by you is now done by them.

But even with an Amazon bookkeeper and accountant, you are not completely free of responsibility.

It is of utmost importance that you do your part of the work: the timely provision of important documents.

Your accountant can only work with the information you provide him with.

So make sure that all invoices, transaction numbers, tax numbers, etc. are delivered on time.

Don’t show up two days before the deadline with huge folders and expect the accountant to get everything properly done within 48 hours.

Checklist: How to Find the Best Amazon Seller Accounting Service

So now you basically know everything there is to know about Amazon Accountants.

In our 3-step checklist we will now show you how to find the right accountant for your business:

1) Define Your Requirements

In the first step, you should be clear about what your requirements are.

What do you want to outsource?

Do you need coaching to train your employees in-house, for example in bookkeeping?

Do you already use certain software that you want your accountant to use as well?

Write down all the requirements you can think of.

The better you know what you are looking for, the more likely you are to find an accountant that perfectly meets your needs and fits your business.

2) Look for a Good Fit

Now that you know what your requirements are, you can start looking for an accountant.

As mentioned above, you can find many Amazon accounting services quickly and easily at Sermondo.

Just use our convenient matching form where you tell us what you are looking for in an accountant (see step 1) and we will connect you with the perfect company for your needs.

3) Interview

Before you decide to hire an accountant, there are a few things you should ask them.

We have compiled a list of the most important questions for you:

- What services are you providing?

- Do you have a team are do you work on your own?

- If you have a team, do I get a designated account manager?

- How many Amazon sellers or vendors have you previously worked with?

- Can I contact former clients of yours?

- Do you have experience in working with businesses of my size?

- What’s your pricing structure?

- What’s the best way to contact you?

- How often should we be in touch?

- What are some things I should consult with you about on a regular basis?

- What are your responsibilities? What are mine?

- How do your workflows look like?

- Can you help me negotiate and/or review business contracts?

- Can you communicate with the official authorities for me?

- What do you need from my side?

- What are some considerations for my type of product or industry in particular?

- How can you help me to reduce costs?

Conclusion

Finding the right accountant to work with is an important task for every Amazon seller. We hope that our guide could answer your main questions about Amazon accountants and that you now feel ready to hire one.